iShares Russell 2000 ETF (IWM)

259.65

-3.72 (-1.41%)

NYSE · Last Trade: Feb 1st, 12:20 PM EST

Detailed Quote

| Previous Close | 263.37 |

|---|---|

| Open | 261.07 |

| Day's Range | 257.94 - 262.98 |

| 52 Week Range | 171.73 - 271.60 |

| Volume | 59,382,156 |

| Market Cap | 752.47M |

| Dividend & Yield | 3.368 (1.30%) |

| 1 Month Average Volume | 38,889,987 |

Chart

News & Press Releases

The company announced it has assembled a new project management team to accelerate development of its flagship Tanbreez rare earths project in Greenland.

Via Stocktwits · January 30, 2026

HDSN Stock In Spotlight As Contract With US DLA Comes Under Legal Scrutinystocktwits.com

Via Stocktwits · January 30, 2026

Breadth Stabilizes, But Heavy Declines Hint at Rotationchartmill.com

Via Chartmill · January 30, 2026

Pathward Financial delivers banking and payment solutions to commercial clients and consumers across the U.S. financial sector.

Via The Motley Fool · January 29, 2026

Innodata announced that it has been chosen by Palantir to provide high-quality training data and data engineering services.

Via Stocktwits · January 29, 2026

Breadth Takes a Breather While Large Caps Hold the Linechartmill.com

Via Chartmill · January 29, 2026

Breadth Re-accelerates While Index Trends Stay Firmchartmill.com

Via Chartmill · January 28, 2026

Breadth Rebounds, But Small-Caps Cool Off at Resistancechartmill.com

Via Chartmill · January 27, 2026

Breadth Cools Into Resistance as Large Caps Hold the Highschartmill.com

Via Chartmill · January 26, 2026

REGENXBIO stated that the FDA has placed a clinical hold on the company’s experimental gene therapy program for the treatment of rare childhood diseases.

Via Stocktwits · January 28, 2026

The company tied up with Davidson Technologies and defense company Anduril Industries to develop quantum-classical hybrid applications for U.S. air and missile defense scenarios.

Via Stocktwits · January 27, 2026

After years of underperformance, small caps are off to a strong start in 2026.

Via The Motley Fool · January 26, 2026

As of January 26, 2026, the financial landscape has undergone a seismic shift, marking the definitive end of the "Magnificent 7" era of uncontested dominance. For the first time in decades, the baton of market leadership has been passed to the small-cap arena in what analysts are calling the "Earnings

Via MarketMinute · January 26, 2026

Small-Caps Still Lead as Participation Broadenschartmill.com

Via Chartmill · January 23, 2026

They're two of the oldest ETFs on the market, tracking two of the most well-known indexes. How does IWM match up against QQQ?

Via The Motley Fool · January 26, 2026

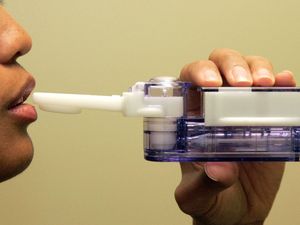

The U.S. FDA approved an update to the prescribing information for Afrezza inhalation powder to treat adults with diabetes mellitus.

Via Stocktwits · January 26, 2026

Small-cap stocks just beat large-cap stocks for 14 straight days.

Via The Motley Fool · January 25, 2026

Explore how IWM’s diversified small-cap mix and higher yield contrast with MGK’s focused tech giants and lower fees.

Via The Motley Fool · January 25, 2026

Small-Caps Lead a Broad Rebound, but the Tape Still Needs Follow-Throughchartmill.com

Via Chartmill · January 22, 2026

Post-Holiday Selloff Hits Breadth - Small-Caps Hold Up Bestchartmill.com

Via Chartmill · January 21, 2026

Explore how portfolio concentration, sector tilt, and risk profiles set these two major ETFs apart for different investor priorities.

Via The Motley Fool · January 24, 2026

Many of the "Magnificent Seven" stocks have been losing steam over the past year.

Via The Motley Fool · January 22, 2026

The company unveiled a $200 million dilution alongside a $90 million investment from healthcare technology heavyweight Medtronic.

Via Stocktwits · January 21, 2026

The company signed a licensing agreement with Pfizer, granting it non-exclusive rights to use Matrix-M adjuvant in up to two disease areas.

Via Stocktwits · January 20, 2026