Latest News

Growth stocks fall in and out of favor with investors, but quality businesses are always worth buying.

Via The Motley Fool · December 28, 2025

Oil is closing 2025 as one of the negative-performing assets.

Via Benzinga · December 28, 2025

One concentrated allocation, a massive backlog, and a takeover price hanging over the stock make this one of the more revealing institutional moves this quarter.

Via The Motley Fool · December 28, 2025

A 10 to 15 percent pullback is coming. It is a done deal.

Via Talk Markets · December 28, 2025

AI everywhere, tokenization and decentralization, energy resilience, biotech/longevity, robotics automation and space

Via Talk Markets · December 28, 2025

I think these two nuclear power corporations are heading a lot lower.

Via Talk Markets · December 28, 2025

This retailer has stood tall through thick and thin in the economy and stock market.

Via The Motley Fool · December 28, 2025

With identical fees and a single-asset focus, these ETFs reveal how underlying crypto choices shape risk and long-term outcomes.

Via The Motley Fool · December 28, 2025

Americans are stressed about finances and hesitant about retirement due to rising costs, low income, and job insecurity. Advisors can help by reframing progress and encouraging small, steady actions.

Via Benzinga · December 28, 2025

Crypto secured regulation, institutions, and adoption in 2025, but confidence never fully followed. 2025 proved crypto’s legitimacy — yet exposed how far it remains from durable, trust-driven growth.

Via Talk Markets · December 28, 2025

When a biotech rallies nearly 200% and still gets trimmed, the real story likely isn’t about fear or a loss of conviction.

Via The Motley Fool · December 28, 2025

Investing in the AI revolution looks like a smart play for the long term.

Via The Motley Fool · December 28, 2025

ANI is firing on all cylinders operationally, which makes this exit less about fundamentals and more about portfolio discipline at a moment when expectations might be sky-high.

Via The Motley Fool · December 28, 2025

The crypto market ends the week at a total market capitalization of $2.98 trillion.

Via Talk Markets · December 28, 2025

Sam Walton's estate planning kept his Walmart stock in a trust, protecting it from divorce courts. This strategy was key to preserving family wealth.

Via Benzinga · December 28, 2025

The move higher in the GBP/USD mirrored movements in the EUR and other currencies against the USD this past week.

Via Talk Markets · December 28, 2025

Berkshire Hathaway was run by Warren Buffett, who many consider to be the greatest investor of all time.

Via The Motley Fool · December 28, 2025

When a lender is firing on all cylinders and still gets cut, it says less about the company and more about how investors might be thinking about risk, timing, and opportunity cost.

Via The Motley Fool · December 28, 2025

A quiet regional bank purchase hints at a longer-term thesis that has less to do with momentum and more to do with patience and balance-sheet math.

Via The Motley Fool · December 28, 2025

Expense-conscious investors weighing emerging markets exposure will find key differences in cost, risk, and portfolio breadth here.

Via The Motley Fool · December 28, 2025

Solana has experienced a negative year in terms of price movement, but that hasn't stopped the constant influx of long-term investors.

Via The Motley Fool · December 28, 2025

Via Benzinga · December 28, 2025

Buffett kept Berkshire's own shareholders in the dark for a year.

Via The Motley Fool · December 28, 2025

With margins holding firm, cash piling up, and AI services quietly compounding, this buy looks less like a quick trade and more like a conviction call hiding in plain sight.

Via The Motley Fool · December 28, 2025

Semiconductor stocks have been some of the biggest beneficiaries throughout the artificial intelligence (AI) revolution.

Via The Motley Fool · December 28, 2025

A deal collapse rewrote the stock’s near-term narrative, so the story has changed quite a bit since quarter-end.

Via The Motley Fool · December 28, 2025

India’s small-cap stocks had a year to forget in 2025.

Via Talk Markets · December 28, 2025

Vivek Ramaswamy is softening his combative image to boost his bid for Ohio governor and navigate GOP culture-war divisions.

Via Benzinga · December 28, 2025

These three cryptocurrencies provide the optimal mix of upside potential and downside protection in 2026.

Via The Motley Fool · December 28, 2025

Make sure you're prepared.

Via The Motley Fool · December 28, 2025

Dividends can make you a millionaire if you invest in the right kind of stocks.

Via The Motley Fool · December 28, 2025

From bold Bitcoin predictions to scathing critiques, the crypto market was anything but quiet this week. Read more.

Via Benzinga · December 28, 2025

The stock is down by 98% over the past five years, and it's not a dip that you want to buy.

Via The Motley Fool · December 28, 2025

Nuclear energy is capturing attention in today's market, but some of the sector's hottest stocks are riskier than others.

Via The Motley Fool · December 28, 2025

Expense-conscious investors face a key choice between broader coverage and focused strategy in the consumer staples sector.

Via The Motley Fool · December 28, 2025

Via MarketBeat · December 28, 2025

Via Benzinga · December 28, 2025

Growing businesses that generate high cash flow have a good chance of creating solid, long-term returns.

Via The Motley Fool · December 28, 2025

Three companies are all neck-and-neck in the race to $2 trillion.

Via The Motley Fool · December 28, 2025

Investors might be more interested in this stock since it trades 21% off its record high.

Via The Motley Fool · December 28, 2025

This week highlighted sharp contrasts across tech and travel, with XPeng boosting shares on Middle East expansion plans, China tightening EV energy rules, Waymo pausing robotaxi services due to weather, U.S. holiday travel thrown into chaos by a winter storm, and Tesla's European sales continuing to slide.

Via Benzinga · December 28, 2025

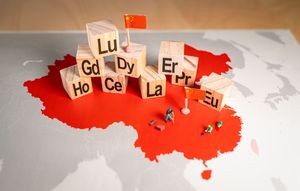

MP Materials is ideally set to take advantage of China's dominance in the rare earth space.

Via Barchart.com · December 28, 2025

An impressive historical gain hasn't prevented this dominant business from seeing its shares soar 64% in 2025.

Via The Motley Fool · December 28, 2025

Top economists and influencers weigh in on inflation, jobs, and wealth inequality.

Via Benzinga · December 28, 2025

Via Benzinga · December 28, 2025

President Trump boasts about tariffs on Truth Social, claiming they have boosted GDP and reduced trade deficit by 60%.

Via Benzinga · December 28, 2025

Blue Origin, the aerospace company established by Amazon founder Jeff Bezos, has announced the appointment of Tory Bruno as the president of its national security division.

Via Benzinga · December 28, 2025

These stocks have all executed splits in recent years, and their core businesses are only getting stronger.

Via The Motley Fool · December 28, 2025

Elon Musk's net worth grew by $205 billion in 2025, surpassing Google co-founders Larry Page and Sergey Brin's combined wealth.

Via Benzinga · December 28, 2025