FactSet’s stock price has taken a beating over the past six months, shedding 31.8% of its value and falling to $288.60 per share. This may have investors wondering how to approach the situation.

Is now the time to buy FactSet, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is FactSet Not Exciting?

Despite the more favorable entry price, we're cautious about FactSet. Here are two reasons why FDS doesn't excite us and a stock we'd rather own.

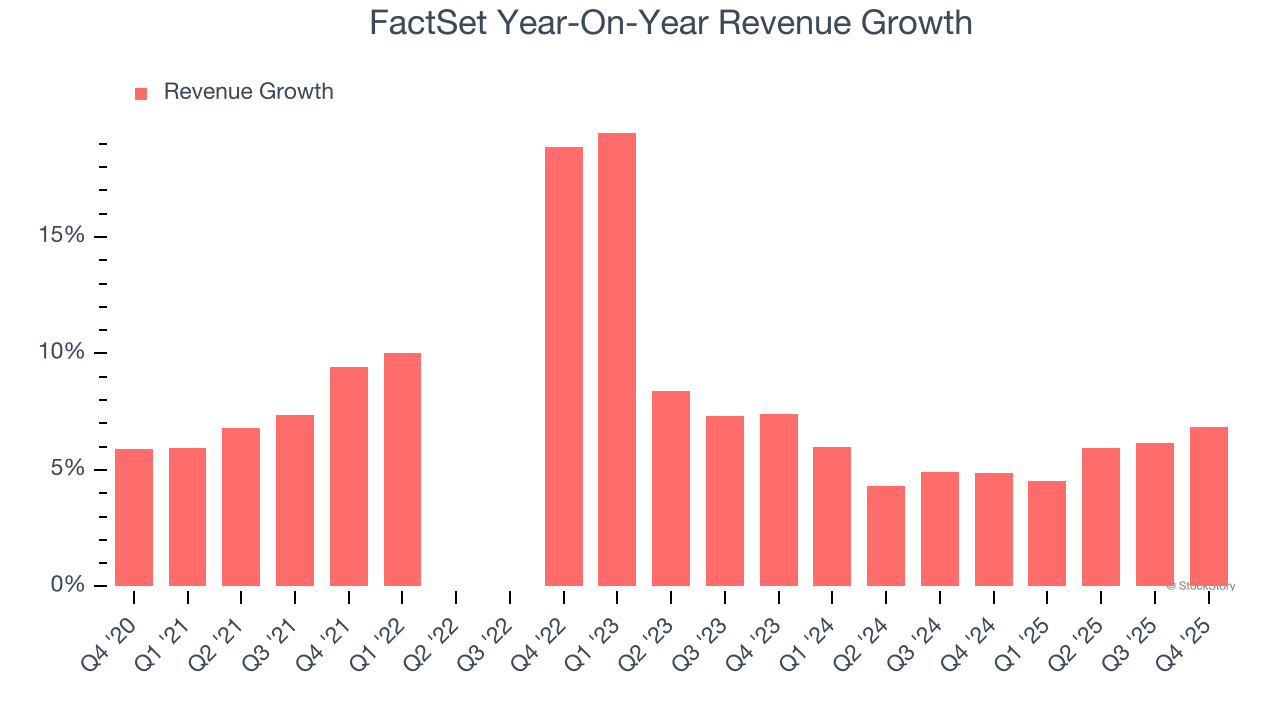

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. FactSet’s recent performance shows its demand has slowed as its annualized revenue growth of 5.5% over the last two years was below its five-year trend.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

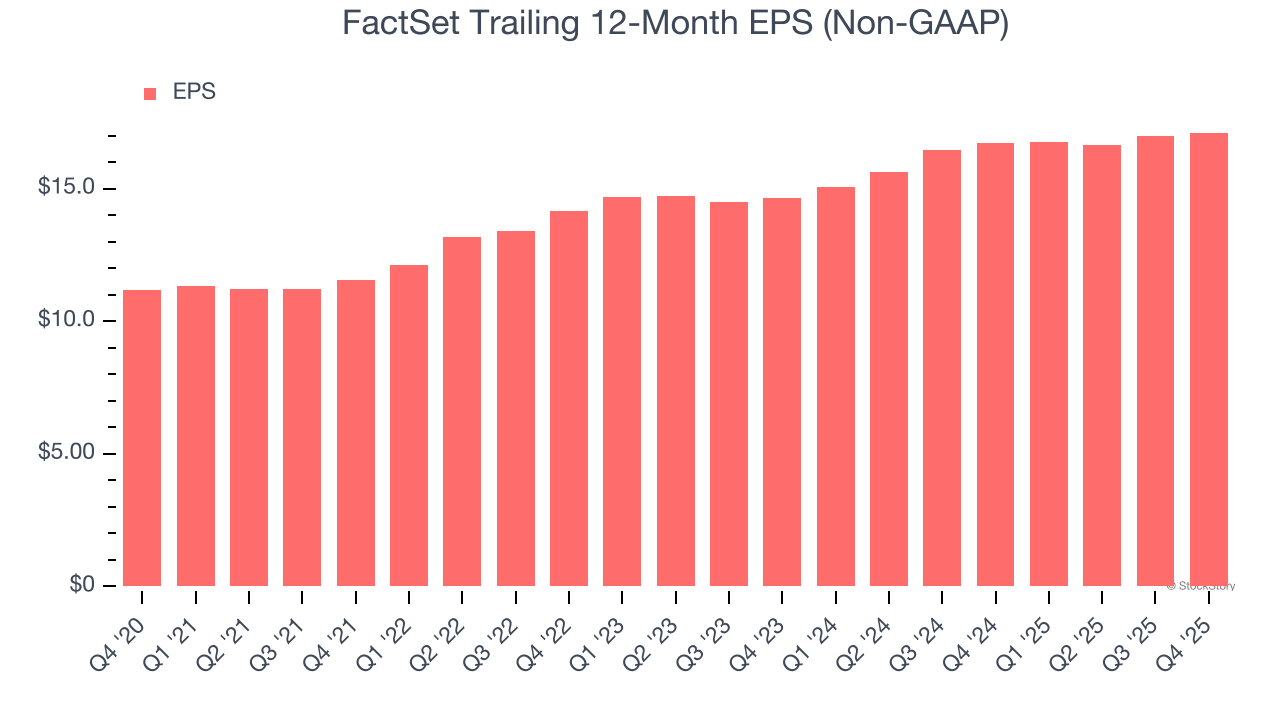

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

FactSet’s unimpressive 8.9% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Final Judgment

FactSet isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 16.2× forward P/E (or $288.60 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of FactSet

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.