Over the past six months, Sensata Technologies’s stock price fell to $28.40. Shareholders have lost 19.7% of their capital, disappointing when considering the S&P 500 was flat. This might have investors contemplating their next move.

Is there a buying opportunity in Sensata Technologies, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about Sensata Technologies. Here are three reasons why you should be careful with ST and a stock we'd rather own.

Why Do We Think Sensata Technologies Will Underperform?

Originally a temperature sensor control maker and a subsidiary of Texas Instruments for 60 years, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

1. Long-Term Revenue Growth Disappoints

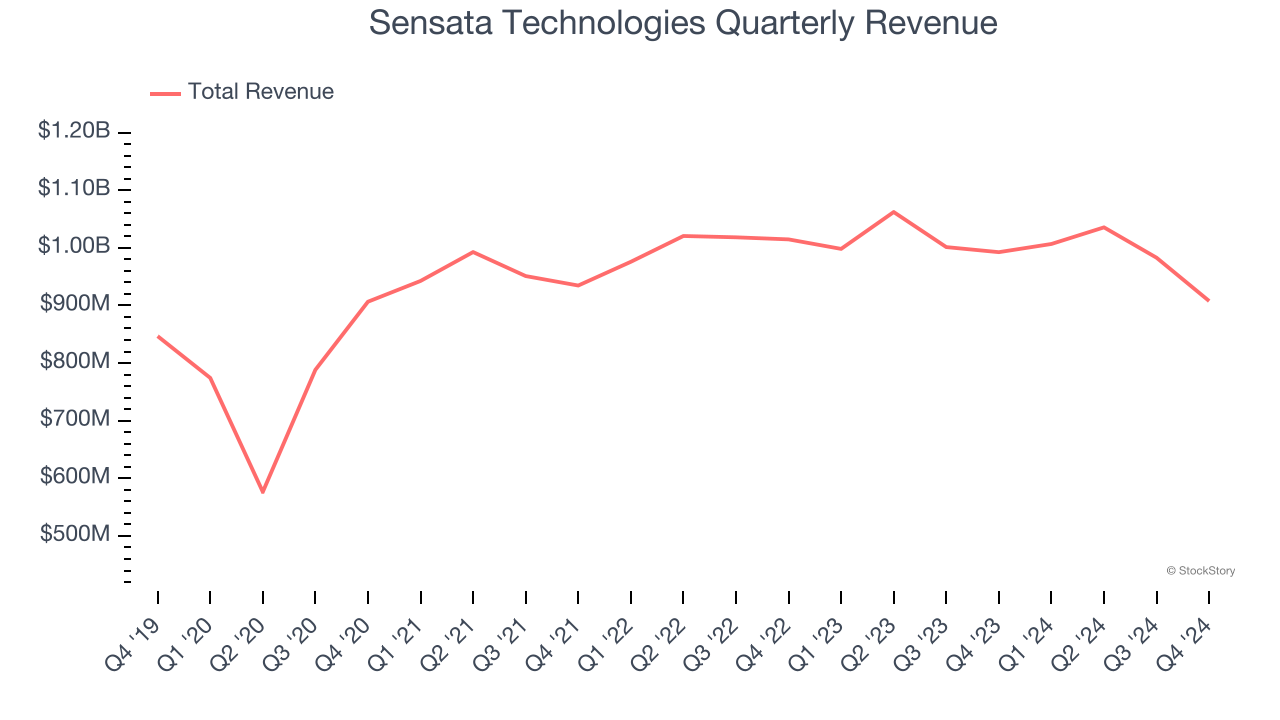

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Sensata Technologies’s 2.7% annualized revenue growth over the last five years was sluggish. This was below our standards. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Sensata Technologies’s revenue to drop by 7.6%, a decrease from its 1.2% annualized declines for the past two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

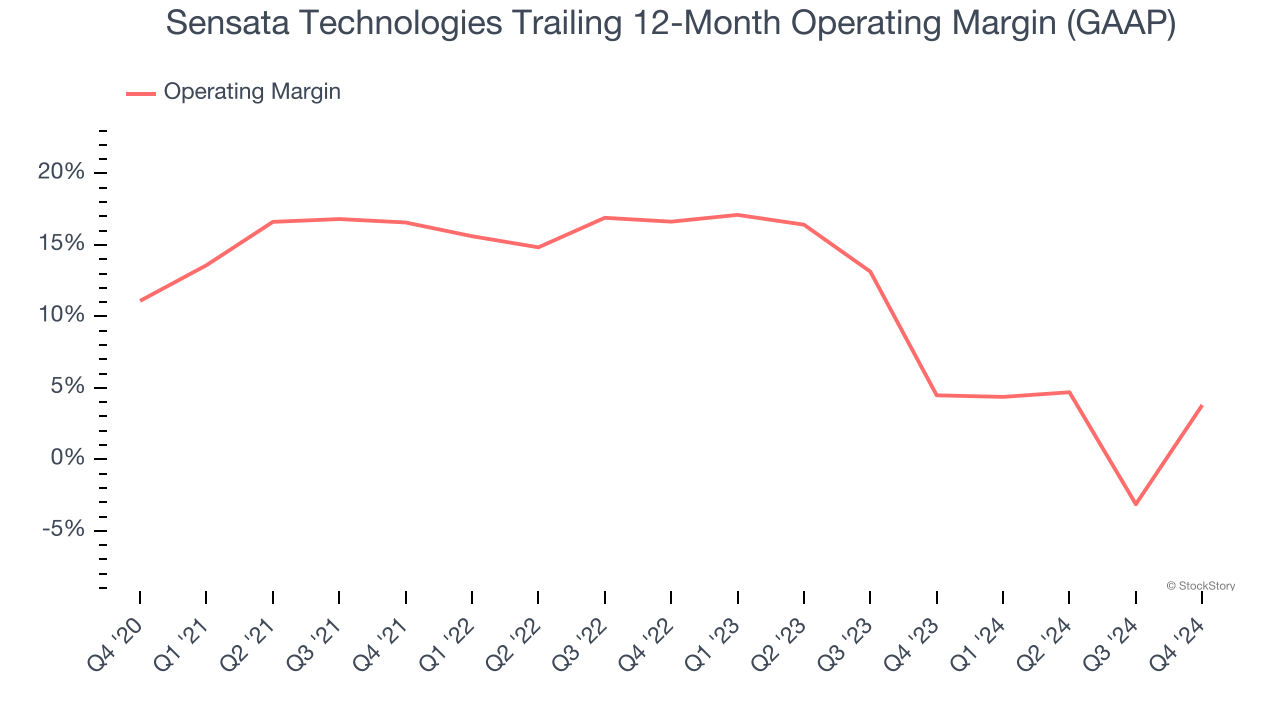

3. Weak Operating Margin Could Cause Trouble

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Sensata Technologies was profitable over the last two years but held back by its large cost base. Its average operating margin of 4.1% was among the worst in the semiconductor sector. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

We see the value of companies furthering technological innovation, but in the case of Sensata Technologies, we’re out. After the recent drawdown, the stock trades at 8.5× forward price-to-earnings (or $28.40 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Sensata Technologies

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.